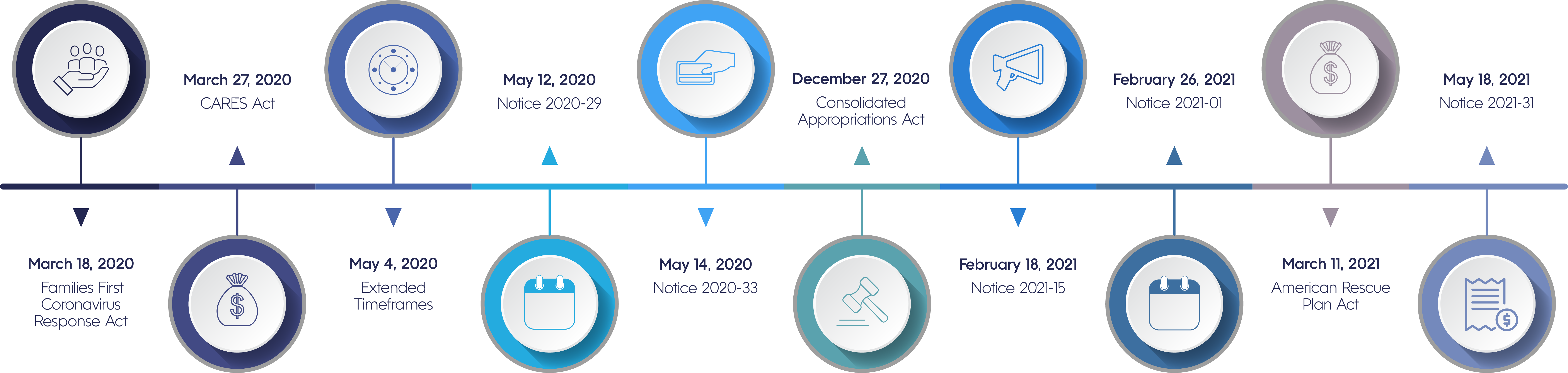

In February, President Biden further extended the National Emergency declaration, which is ongoing today. We are, however, beginning to see the light at the end of the tunnel as vaccinations increase. It’s been a long, tiresome road, and we wanted to recap on a few of the changes that came about due to the pandemic.

We put together a timeline of events describing how COVID has affected the employee benefits industry.

March 18, 2020: Families First Coronavirus Response Act

The FFCRA requires all employers with less than 500 employees and public employers, regardless of size, to provide paid sick leave or expanded FMLA for reasons related to COVID-19.

- Paid sick leave for up to 80 hours at 100% of salary

- Paid sick leave for up to 80 hours at 2/3 of salary to care for a child whose school/daycare closed due to COVID-19

- Covers weeks 3-12 of expanded FMLA at 2/3 of salary for the need to leave due to school or childcare provider closing because of COVID-19

- Applies to employees who have worked at least 30 days

- Employers eligible for tax credits

- Terminated December 31, 2020

March 27, 2020: CARES Act

The Coronavirus Aid, Relief, & Economic Security Act provided economic assistance for workers, families, small businesses, and industries.

- COVID-19 testing and diagnosis covered at 100%

- Included Paycheck Protection Program, which kept workers of small businesses paid and employed during National Emergency

May 4, 2020: Extended Timeframes

- Outbreak Period established (March 1, 2020 – 60 days following the end of National Emergency)

- COBRA monthly installments due no sooner than 30 days after the first day of the period for which payment is being made and cannot require payment of premiums before 45 days after the day of initial COBRA election

May 12, 2020: Notice 2020-29

- Extended the claims period for FSAs and DCAP

- Extension through December 31, 2020 (non-calendar year plans) given to spend unused FSA amounts

- Expanded ability to make mid-year election changes to health coverage, FSAs, and DCAP

May 14, 2020: Notice 2020-33

- Increased limit for unused FSA carryover amounts from $500 to $550 (without penalty)

December 27, 2020: Consolidated Appropriations Act

- Recognized we were still reeling from the effects of Coronavirus

- Extended grace period to 12 months for plan years ending in 2020 or 2021

- Permitted participants who terminated in 2020 to continue receiving reimbursements of unused money through the end of the plan year

- Allowed employers who mandatorily complied through December 31, 2020, to continue the program through March 31, 2021, voluntarily and still receive tax credits

February 18, 2021: Notice 2021-15

- Provided temporary special rules for FSAs and DCAP under Cafeteria Plans, including:

- Gave flexibility to carryovers of unused amounts from the 2020 and 2021 plan years

- Extended the permissible period for incurring claims for plan years ending in 2020 and 2021

- Permitted midyear prospective election changes to the health plan

February 26, 2021: Notice 2021-01

- The Departments established an Outbreak Period (March 1, 2020 - 60 days following the end of National Emergency)

- Prior COVID-19 extensions extended again for an unspecified amount of time up to one year

- Affected deadlines of employee benefit plans pursuant to ERISA and the Internal Revenue Code, including:

- Special enrollment timeframes

- COBRA election and payment timeframes extended

- Deadline to file claims, appeals, and requests for external review

- Deadline for plans to provide COBRA election notice

March 11, 2021: American Rescue Plan Act

- Gave COBRA subsidies to Assistance Eligible Individuals

- Allowed paid time off to get the COVID vaccine

- Employers eligible for tax credits

- Allowed the DCAP benefits to increase retroactively to January 1, 2021, from $5,000 to $10,500

- Updated FFCRA and DCAP

May 18, 2021: Notice 2021-31

- Provided guidance on tax breaks under the ARPA for continuation health coverage under COBRA

- Employers may require attestations to AEI status

- Allowed coverage if in a disability period extension

- Explained procedures to get tax credit - Form 941 - or advance payments - Form 7200

We will continue to keep you informed on notices from the IRS and more as we navigate COVID-19. For a more detailed account of any of the regulations mentioned above, subscribe to our YouTube channel for an extensive collection of educational webinars. And as always, if you have any questions or are interested to know how Medcom can help you and your team, please feel free to contact us.